Third-party investment has become a central part of sport’s ‘new normal’ landscape. Private equity capital and expertise has provided much needed assurances and confidence to realise long-term future growth across international sport in a period of much uncertainty. While there is still some scepticism over the long-term impact of private equity in sport, the deals that we have seen across American ball sports, European football, rugby and volleyball, go beyond rights holders’ short-term need for financing to realising a more sophisticated, relevant and modern future for sport that benefits all invested stakeholders, particularly the fan.

However, the emergence of SPACs within sports ecosystem presents a potentially seismic shift in the landscape by fundamentally altering the established business model and catalysing further increases to franchise valuations to unsustainable levels.

Prior to 2020, ‘SPAC’, short for Special Purpose Acquisition Company, were confined to a niche financial concept that refers to an alternative method of taking a company public. However, alongside ‘social distancing’, ‘track and trace’ and ‘self-isolation’, SPACs have become an increasingly frequent point of conversation, particularly within sport.

While the phenomenon of private equity investment in sport is no longer a black swan, The Sports Consultancy questions whether the presence of readily available SPAC capital on a two-year ‘shot clock’ could lead to unsustainable valuation bubbles as well as fundamentally altering existing, and successful, club and league models through the process of going public.

The global pandemic has further underlined the resilience of consumer demand for sport, and how despite the most challenging of circumstances, it can deliver value to its stakeholders. Therefore, it is no surprise that there has been a sudden and unprecedented increase in sports-related investment funds looking to capitalise on strong year-on-year franchise valuation growth.

Since last year, there have been at least 45 sports-related SPACs formed, drawn by a mix of factors including investor demand and accelerated growth in areas such as online betting and sports-related analytics. For now, they have mainly exploited these fast-growing have had some success, particularly with the DraftKings merger.

However, given the incredibly strong increase in sport franchise valuations as well as the relaxation of ownership regulations amongst America’s major sports leagues, it might not be long before the first successful SPAC merger with a sports team or league. This would signal a major shift in sport’s established business model and drive already high valuation prices even further up.

What is a SPAC and why are they looking at sport?

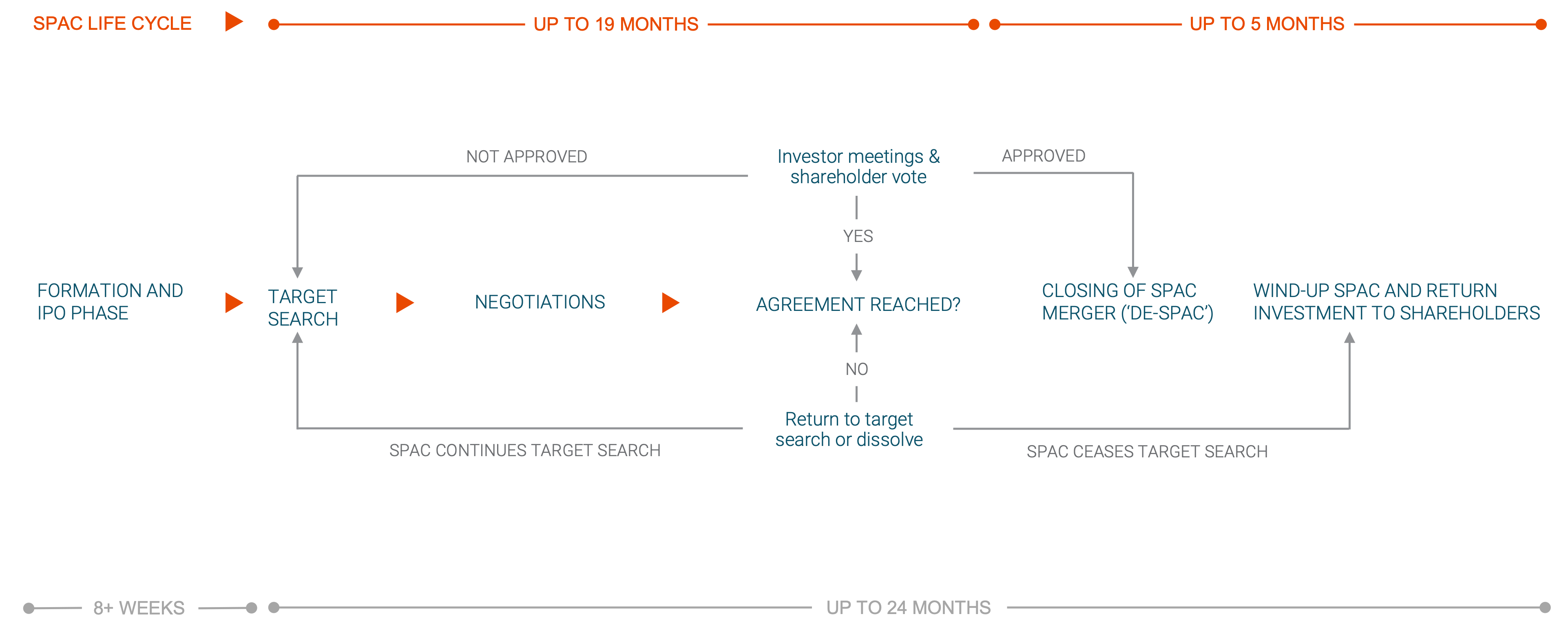

Put simply, a SPAC is a specially formed company with no trading history that lists for the purpose of acquiring a private company, thus taking it’s target public without going through the traditional initial public offering process.

SPACs are not a new concept, but the ongoing pace of SPAC IPOs is unprecedented. In 2021, over 80% of IPOs have been SPACs, with industry experts estimating that SPAC merger activity could reach $700bn by the end of 2022.

There are multiple benefits to SPAC mergers as they offer more flexibility, quicker to structure and materialise and allow companies to be valued on future growth projections as opposed to historic performance, meaning they particularly appeal to businesses looking to raise significant capital quickly.

However, SPACs typically have just 24 months to make an acquisition following the shell company IPO otherwise they have to return their sponsor investment.

Sport has become a particular interest area for these SPACs as they look to capitalise on the valuations of sports teams, sports betting organisations and technology innovators operating across the sports, gaming and gambling space. 35 sports-related SPACs have formed in 2021 alone, raising a total of $9.1bn, while in 2020, 53 sports figures and sports-business SPACs raised $20.5bn.

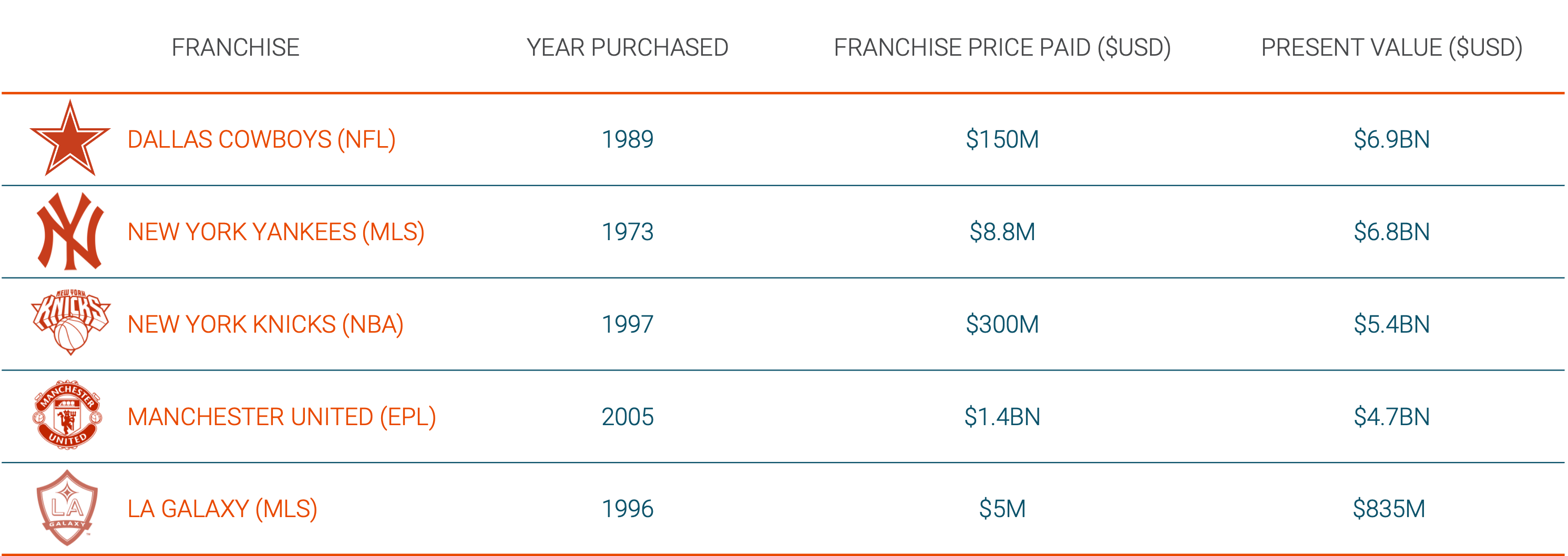

Sports franchise values continue to rise:

The major issue on the horizon: too much money chasing too few opportunities

There is over $13bn of sport SPAC related money currently in market seeking business. These funds have less than 12 months to complete a deal or risk having to give their investors’ money back. This has and is causing a significant pressure to build up given the way SPACs are structured and with the impending deadline fast approaching, SPACs chasing mergers could fuel a drive in valuations and poor investments.

‘I do think the market has gotten very, very frothy, and I do see a couple of cautionary flags. Is there too much SPAC money chasing too few opportunities?’

Jeff Sagansky, President of Double Eagle Acquisition

Exacerbating the problem? Major US sport leagues relax owner regulations to welcome new capital investment as franchise valuations soar

Over the last 24 months, America’s biggest sports leagues (NFL, NBA and MLB) have sanctioned fundamental changes in their ownership regulations in order to make it easier to invest in their franchise teams.

Soaring franchise valuations and rising media rights revenues have been two of the standout trends in North American sport for the last decade, with strong year-on-year growth seen across all the major leagues. This upward trend has prompted an exponential increase in interest from institutional investors that have historically been prevented from investing through strict ownership rules that favoured individual / family owners.

However, as valuations continue to rise there is a real issue that the pool of potential buyers is increasingly shallow, leaving fears that franchise values might start to plateau in the long run. This has led to a concerted effort to lower the barrier to entry, in particular to encourage more minority stake investors.

The aim of relaxing the regulations to open up to capital markets is to widen the pool of potential buyers, generate greater competition and therefore help fuel further rises in team valuations. These changes have already had a profound impact on the US sports landscape through a number of high-profile private equity investment plays into some of America’s biggest sports teams.

SPAC investment may well become a factor in this, particularly as their 24 month timeframe begins to tick down. With a limited number of franchises to invest in and so much capital in the market, aggressive valuations that are typical of SPACs may well drive astronomical prices.

Ultimately sport is a cash consumer and while traditionally that void has been filled by media and sponsorship deals, as the demand for greater revenues continues to grow, new avenues will be explored, as seen through the recent flurry of cryptocurrency related deals in sport.

It is hard to argue that if readily available SPAC money is near to hand that major sports teams and leagues will turn this down.

The crucial question is whether these organisations will go a step further and push for access to public markets in return for sizeable investment but at the loss of a degree of control.

Private equity investment floods into NBA franchises following owner rule changes

In January 2021 the NBA amended their owner regulations to allow private equity and other types of institutional investors to own up to 20% equity in up to five teams.

Since then, there has been 8 major investments into NBA franchises, with 5 involving private equity funding.

SPAC investment in sport so far:

SPACs entry into sport has been opportunistic, focusing primarily on companies leveraging the relaxing of betting regulations and increased requirement for technological advancement with bullish growth projections.

For fast growing companies within the gambling / data space such as Genius Sport and DraftKings, SPAC financing has provided the perfect cash raising vehicles to become public on aggressive valuation listings. They can show a major addressable and untapped market as well as demonstrate rapid recent growth and a strategy for future growth that suits how SPACs value companies based off future earnings.

SPAC success story: DraftKings

Property: DraftKings

Type of company: Online Sportsbook

SPAC: SBTech and Diamond Eagle Acquisition

Initial listing: $17.81

Current value: $51.53

The hype for SPACs really picked up following the hugely successful example set by online sportsbook DraftKings. On its first day of trading, DraftKings shares rose 10% to $19.4, a record high that gave the company a value of roughly $6.3 bn. Its value has continued to rise steadily since, with a $21 bn market valuation, an increase of 233% since the end of its first day’s trading.

Sportsradar SPAC failure exposes significant flaws

However, aggressive SPAC valuations based off future forecasts in volatile markets has led to several high-profile failings, particularly Sportsradar.

Property: Sportsradar

Type of company: Sports data provider

Failed SPAC: Horizon Acquisition Corp. II

Initial IPO listing: $28.62

Current value: $22.47

In March this year, Sportradar attempted to go public via a SPAC merger with Horizon Acquisition Corp. II, led by LA Dodgers minority owner Todd Boehly, at a $10 bn valuation. The valuation was based largely on its future growth potential, given that the US only contributed to 6% of overall company revenues in 2019 (before betting was legalised). However, the deal fell through due to an over valuation and failed PIPE funding.

Since then, Sportradar has gone public through a traditional IPO at a valuation of $8bn and initial share price of $28.62. Following a 7% decline on its first day trading, the share price has continued to fall as traditional investors remain sceptical over the company’s valuation.

So, what does the future hold for SPACs and sport investment?

Institutional investment in sport is here to stay and will increase over the next 3-5 years as rights holder seek to recover lost revenues from the pandemic and realise future transformational growth.

KPMG estimates that COVID has led to 20 of Europe’s biggest clubs losing more than €1bn in revenues over the last year, while teams across the NFL and MLB have lost $7bn and $4bn in matchday revenues alone.

These losses help in part to explain the unprecedented and dramatic rise in investment activity in sport that pre-pandemic was relatively sporadic and isolated.

Investment powerhouses like CVC Capital Partners and Bruin Sports Capital come with a guaranteed certificate of quality and expertise to transform the businesses they invest in. Through their investment in sport leagues, teams and technology and data providers, and associated expertise, plans to digitise content and expand addressable audiences through more sophisticated CRM and data analytics, which were looking at 5-10 years in the planning and execution, are coming on stream now.

Whether SPACs prove to be as an astute partnership for sports teams and leagues to realise future growth remains to be seen. We are sceptical that SPACs investment model and valuation methodology is compatible with traditional sport. While there is not an inherent issue with sports teams being public, as Manchester United and Green Bay Packers demonstrate, in general they favour long-term capital growth over annual returns to shareholders.

It seems that SPACs are better suited for gaming, data and betting sectors, but with over $13 billion of SPAC funding needing to be invested within the next 12 months, there could well be an influx to more traditional leagues and teams.

If this is the case, there is a real danger that SPACs could drive a bubble in franchise valuations and capitalise on relaxed ownership rules restrictions to fundamentally alter the established status quo.

For any enquiries, please contact Alistair Taylor at The Sports Consultancy Alistair.taylor@thesportsconsultancy.com